Running an e-commerce store without proper tax configurations is like driving without a seatbelt: it works until it doesn’t.

In 2023, 60% of small businesses faced tax penalties due to incorrect filings, with the average fine exceeding $5,000 (Avalara Tax Compliance Report).

For Shopify merchants, mismanaged tax settings can lead to revenue loss, legal headaches, and customer dissatisfaction.

Shopify’s built-in tax tools simplify compliance, but only if configured correctly.

This guide breaks down everything you need to know about Shopify tax settings, from automated calculations to international VAT compliance, ensuring your store stays audit-ready in 2024 and beyond.

Key Takeaways

- Unlock the power of Shopify’s Automated Tax feature to reduce tax errors by up to 90%.

- Configure tax settings for the US, EU, Canada, and Australia in 3 straightforward steps.

- Discover hidden tax exemption rules for cross-border sellers (ignoring these risks audits).

- Avoid $10,000+ penalties from misconfigured tax zones,learn from a real-world case study.

- Get insider tips on generating audit-proof tax reports for accountants.

What Are Shopify Tax Settings (And Why Do They Matter)?

Shopify tax settings determine how your store collects, reports, and remits taxes based on your business location, customer addresses, and product types.

Whether you’re selling in New York or New Delhi, these settings ensure compliance with local tax laws.

Two Ways Shopify Handles Taxes

1. Manual Tax Configuration: You input tax rates for each region. Ideal for simple, local-only sales.

2. Automated Tax (Recommended): Shopify automatically calculates taxes using real-time rates and regional rules. Integrates with Avalara for advanced compliance.

Why automate? Manual setups lead to errors 3x more often than automated systems (Shopify Merchant Survey, 2023).

Recommended Blogs for You:

👉 Essential Legal Pages for Shopify: Complete Setup Guide

👉 Shopify Security Guide: Protect Your Store and Customers

👉 Shopify Mobile Optimization Guide: Boost Mobile Sales

👉 Essential Shopify Apps Guide: Must-Have Tools for Growth

How Shopify Handles Tax Compliance

Shopify’s Automated Tax feature is a game-changer for global sellers. Here’s how it works:

1. Automatic Tax Calculation

Applies the correct tax rate at checkout based on:

- Customer’s shipping address.

- Product type (e.g., clothing vs. digital goods).

- Regional tax laws (e.g., Canada’s HST vs. US sales tax).

2. Global Tax Coverage

Shopify supports tax compliance in 175+ countries, including:

- United States: State-specific sales tax (e.g., California’s 7.25%).

- European Union: VAT rates from 15% (Luxembourg) to 27% (Hungary).

- Canada: GST/HST (5–15%) and provincial taxes (PST/QST).

- Australia: Flat 10% GST on most goods.

3. Tax Nexus Detection

Automated Tax tracks nexus thresholds (physical or economic presence) to determine where you owe taxes. For example, in the US, selling over $100,000 annually in a state typically triggers nexus.

Step-by-Step Guide to Configure Shopify Tax Settings

Follow these steps to set up foolproof tax configurations:

Step 1: Enable Automated Tax in Shopify

- Go to Settings > Taxes and duties

- Select Your Store’s Region

- Enable Automatic Tax Calculation

- Review Tax Settings

- Save Changes

Step 2: Enter Your Business Address

1. Under Tax registration IDs, input your business address.

2. Add tax IDs like EIN (US) or VAT number (EU).

Step 3: Configure Tax Regions

1. Click “Add a tax region” to select countries/states where you have nexus.

2. For the US: Select states where you’ve met economic nexus thresholds.

3. For the EU: Enable OSS (One-Stop Shop) to file VAT returns centrally.

Step 4: Review Tax Overrides (Optional)

Edit specific rates for regions or products (e.g., exempt books from tax in Germany).

Understanding Tax Rates and Regional Rules

Tax rates vary drastically by location and product category. Here’s a breakdown:

United States: Sales Tax Chaos

State-Level Complexity: No federal sales tax. Rates range from 0% (Oregon) to 7.25% (California).

Case Study: A Texas-based seller faced a $12,000 penalty for missing local “city taxes” on Shopify. Always enable county-level tax collection.

European Union: VAT Made Simple

Standard Rates: 15–27% VAT across member states.

Reverse Charge Mechanism: B2B sales in the EU require VAT to be paid by the customer’s local tax authority.

Canada: GST/HST + Provincial Taxes

Federal Tax: 5% GST or 15% HST (combined federal/provincial).

Dual Taxation: In Quebec, charge both GST and QST (9.975%).

Australia: Flat GST Rate

10% GST on most goods. Use Shopify’s tax exemption tool for exports outside Australia.

Tax Overrides and Exemptions: When to Use Them

Override Tax Rates

- Temporary Promotions: Offer tax-free holidays (e.g., back-to-school sales in Texas).

- Specific Products: Exempt groceries or medical items where legally allowed.

How to Exempt Customers from Tax in Shopify

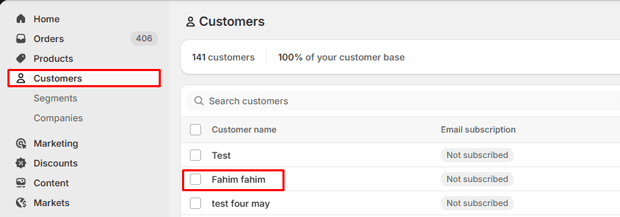

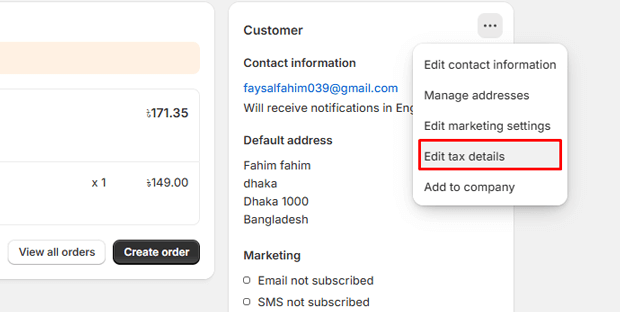

Go to Customers in your Shopify admin. Select the customer you want to exempt.

Click Edit beside “Tax Details”

Check the option Exempt customer from tax.

Save the changes.

Critical Rule: Always request tax exemption certificates (e.g., Form ST-7 in New York) to avoid penalties.

Reporting and Filing Taxes: Turn Data Into Compliance

Generate Tax Reports

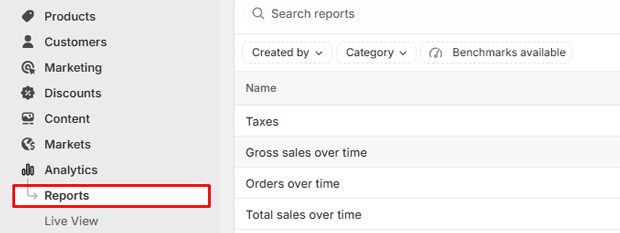

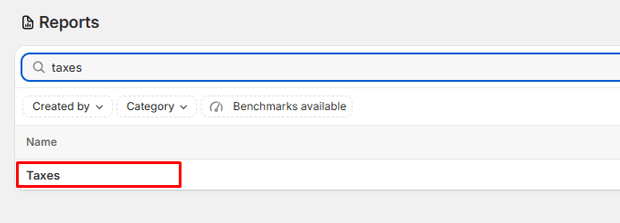

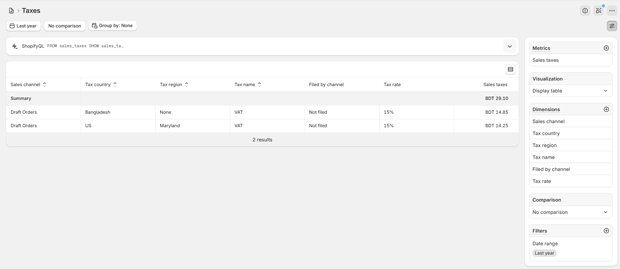

1. Navigate to Analytics > Reports

2. Go to the Taxes Reports

3. Filter by date range and region. Export to CSV or Excel.

Integrate With Accounting Software

Link Shopify to QuickBooks Online or Xero for seamless tax reconciliation.

Common Shopify Tax Mistakes (And How to Avoid Them)

1. Ignoring Economic Nexus Thresholds

2023 Update: Over 30 US states now enforce $100K/200 transactions as nexus triggers.

2. Mislabeling Digital Goods

Example: SaaS products are taxed at 0% in Texas but 100% in Norway.

3. Failing to Update Tax Exemptions

Renewal: Tax-exempt statuses (e.g., resale certificates) expire every 1–2 years.

4. Undercharging International VAT

Penalty: The UK charges 12% interest on unpaid VAT arrears.

Freequently Asked Questions

Does Shopify automatically calculate international taxes?

Yes, with Automated Tax enabled. It pulls live rates for 175+ countries.

How do I charge VAT on Shopify?

Enable VAT calculation under Settings > Taxes. For intra-EU B2B sales, use the reverse charge mechanism.

Can I exempt wholesale customers from tax?

Yes. Go to Customer Settings > Tax Exemptions to toggle off tax for specific buyers.

How often should I update tax rates?

Automated Tax updates rates automatically. Manual setups require quarterly reviews.

What’s the penalty for non-compliance?

Varies by region: The IRS charges $200/month for unfiled returns, while EU fines reach 20% of owed taxes.

Conclusion: Master Shopify Tax Settings to Scale Confidently

Properly configured Shopify tax settings are your first line of defense against penalties and audits.

By leveraging Automated Tax, understanding regional nuances, and staying updated on compliance changes, you’ll not only protect your profits but also build trust with global customers.

Ready to audit your store? Start by enabling Automated Tax today,and don’t forget to bookmark Shopify’s Tax Guide for ongoing updates.